Calculate my paycheck massachusetts

It is also useful for. Well do the math for youall you need to do is.

Payroll Tax Calculator For Employers Gusto

Youll then get your estimated take home pay a.

. But calculating your weekly take-home. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. The state tax year is also 12 months but it differs from state to state.

Simply enter their federal and state W-4. The tax is 351 per pack of 20 which puts the final price of cigarettes in. Below are your Massachusetts salary paycheck results.

How Your Paycheck Works. If your employer doesnt withhold for Massachusetts taxes you will have to pay those taxes in a lump sum at tax time or make estimated tax payments to the state using form Form 1-ES. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. This contribution rate is less because small employers are not. After a few seconds you will be provided with a full.

Some states follow the federal tax. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Massachusetts has some of the highest cigarette taxes in the nation.

Paycheck Results is your gross pay and specific deductions from your paycheck. Enter your employment income into the paycheck calculator above to find out how taxes in Massachusetts USA affect your finances. Just enter the wages tax withholdings and other information.

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Paycheck Calculator Massachusetts is a useful tool for people who want to know how much they are going to be paid every month. The results are broken up into three sections.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages.

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. New employers pay 242 and new. Massachusetts Hourly Paycheck Calculator.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts. It can also be used to help fill steps 3 and 4 of a W-4 form. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and.

![]()

Massachusetts Paycheck Calculator 2022 With Income Tax Brackets Investomatica

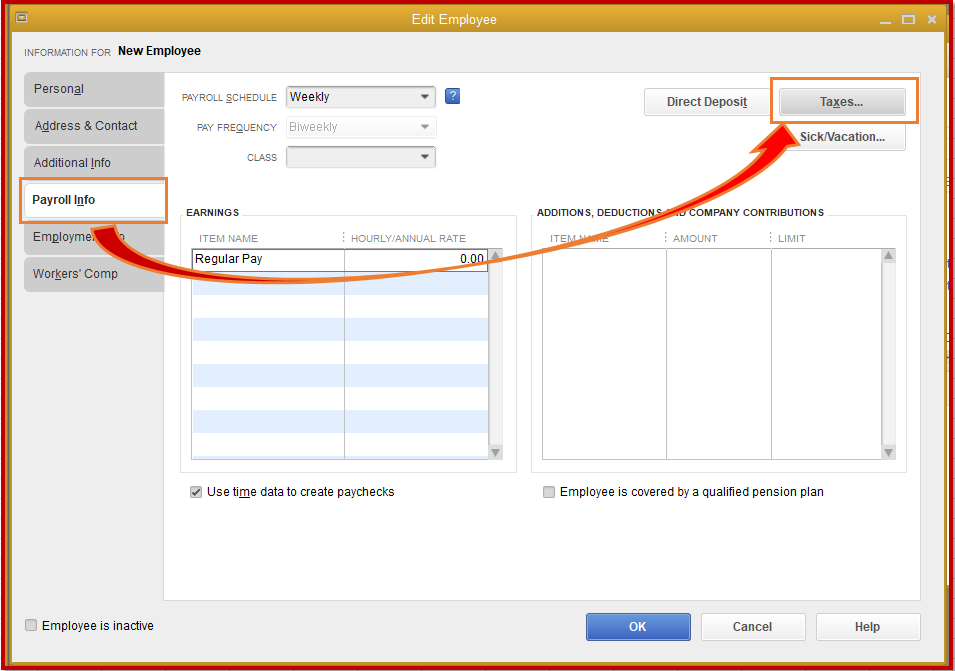

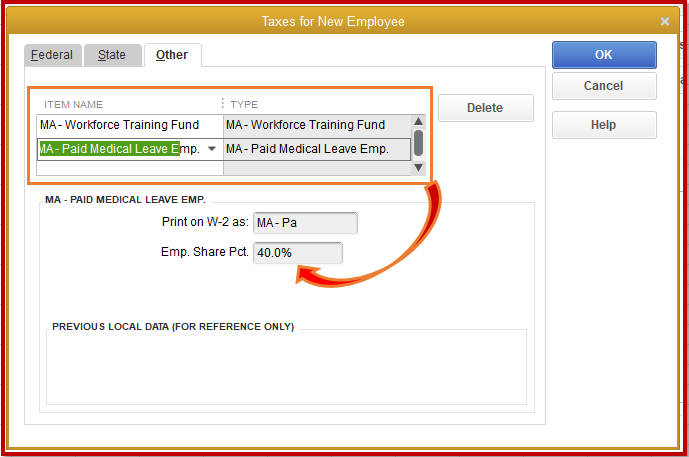

Massachusetts Paid Family Leave Not Calculating Correctly

Massachusetts Salary Calculator 2022 Icalculator

Massachusetts Salary Paycheck Calculator Gusto

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

Massachusetts Paycheck Calculator Smartasset

Massachusetts Paid Family Leave Not Calculating Correctly

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

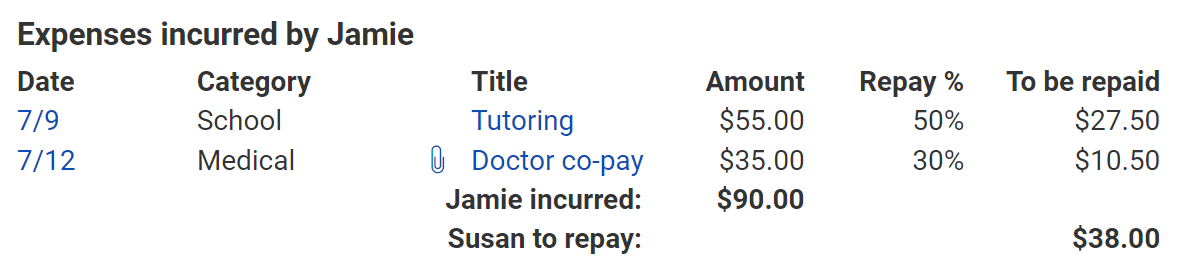

The Easiest Massachusetts Child Support Calculator Instant Live

Massachusetts Paycheck Calculator Smartasset

Take Home Pay Calculator

Massachusetts Wage Calculator Minimum Wage Org

Massachusetts Paycheck Calculator Tax Year 2022

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Massachusetts Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Massachusetts Estate Tax Everything You Need To Know Smartasset